Dear ATM Users, We would like to inform you that effective December 1st, 2024, the ATM located at our branch will be permanently taken out of service and will not be replaced. We understand the importance of convenient access to your funds and would like to remind you that as a member of Equity Credit Union, you have access to a … Read More

Notice for Members that have a Collabria Credit Card

Equity Credit Union Members, We want to inform you about a recent security alert from our credit card supplier, Collabria. They have identified a suspicious website, collabriacreditcards.life, which may be a phishing site targeting Collabria cardholders. Although this site is not yet active, it is designed to mimic the official Collabria website and could potentially be used to capture sensitive … Read More

ACTION REQUIRED: Implementation of Two-Factor Authentication (2FA)

In the rapidly evolving landscape of online banking, ensuring the security and privacy of our customers’ financial information is of utmost importance. As part of our commitment to providing a secure banking environment at Equity Credit Union, we announce the upcoming implementation of Two-Factor Authentication (2FA). This additional layer of security is designed to protect our customers from unauthorized access … Read More

Changes to the Exchange Network

Kindly note that starting March 18, 2024, HSBC will cease to be a member of The Exchange Network. This change is a result of HSBC’s impending acquisition by the Royal Bank of Canada. As a consequence, our members won’t be able to conduct transactions at HSBC ATMs after March 18, 2024. For alternative surcharge-free ATM options, please visit theexchangenetwork.ca, where you … Read More

Protect Yourself from the Most Common Scams in 2024!

At Equity Credit Union, your financial security is our top priority, and we want to make sure you are aware of the most common scams affecting Canadians in 2024. Recent statistics and reports indicate an alarming increase in fraudulent activities, making it crucial for all of us to stay vigilant and informed. According to an Ipsos poll published in February … Read More

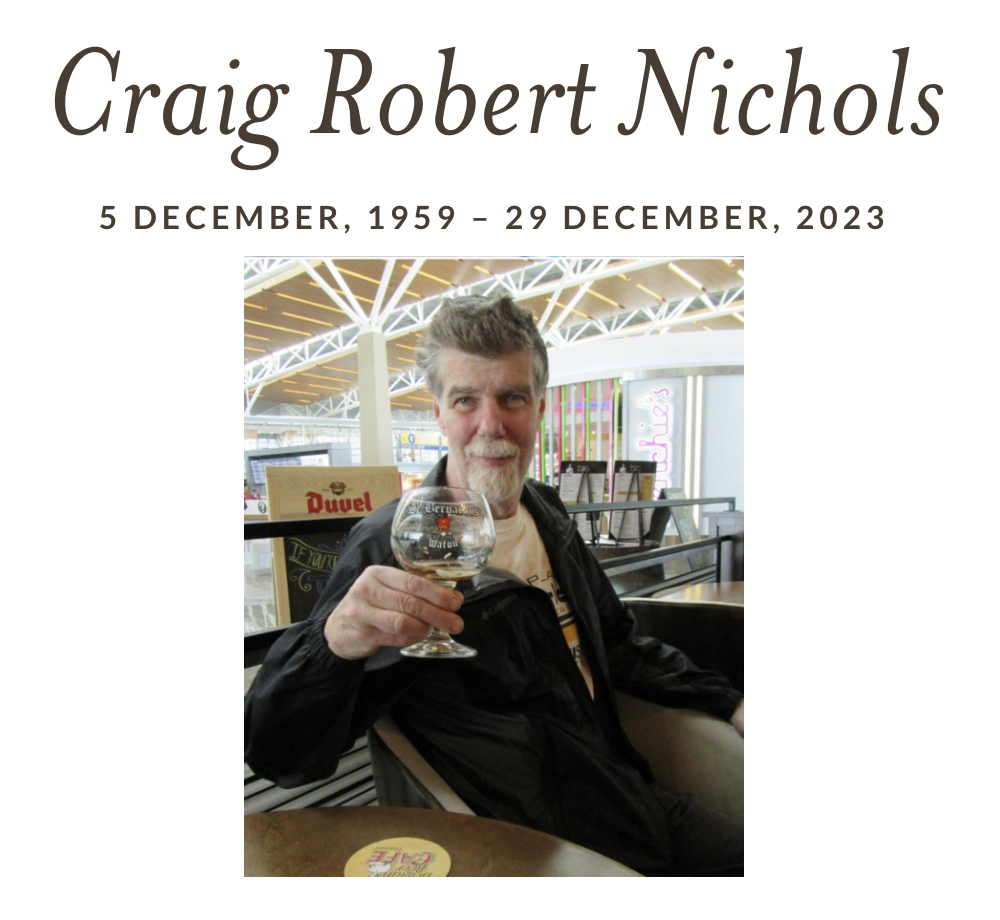

In Memoriam: Craig Robert Nichols

It is with deep sorrow that we announce the passing of our esteemed Director, Craig Nichols, who left us on December 29th, 2023. Craig had been an integral part of our credit union family since 1973 when his father opened an account for him. Serving as a dedicated director since 2010, Craig’s contributions have left an indelible mark on our … Read More

Equity Team Accomplishments

Passion and Commitment keeps Equity’s team focused and energized Where staff at other financial institutions come and go, Equity’s key team members are here for the long-term to keep our members happy and prosperous. When it comes to long-term commitment, it starts at the top at Equity. Our trusted CEO, Tom Dimson, has celebrated 30 years with Equity, helping the … Read More

Equity Website Notice & Online Protection Tips

As you know, the security of your online banking experience with Equity Credit Union is a high priority. Unfortunately, this month we were alerted that, our website, equitycu.com, fell victim to fraudulent activities as it was cloned by scammers. No personal information or accounts were compromised or accessed nor can be accessed or compromised. Equity Credit Union takes the security of … Read More

Introducing First-Home Savings Account

Get into the housing market faster with a tax-free First Home Savings Account (FHSA) from Equity! Equity’s FHSA is a new registered account created to help you save up to $40,000, tax-free, toward a downpayment on your first home. Think of it as a mix between a RRSP and a TFSA: Like a RRSP…contributions to a FHSA are tax-deductible Like … Read More

Another Milestone – 80 years in business and still growing

Equity Credit Union Inc. celebrated its 80th anniversary on April 12, 2023. Our Members, Staff, Management and Directors convened at the Ajax Convention Centre and enjoyed an excellent celebration in this elegant venue. We occupied two conference rooms and hosted 251 members and guests including representatives of FSRA, our legal counsel and auditors. A buffet dinner was enjoyed by all. … Read More

- Page 1 of 2

- 1

- 2